year end accounts cost

If you have a private limited company that does not need an auditor you could file your company accounts through the same service as your company tax return. Year End Inventory Accounting To ensure that reported figures for inventory cost of sales and other expenses are accurate and complete certain procedures must be carried.

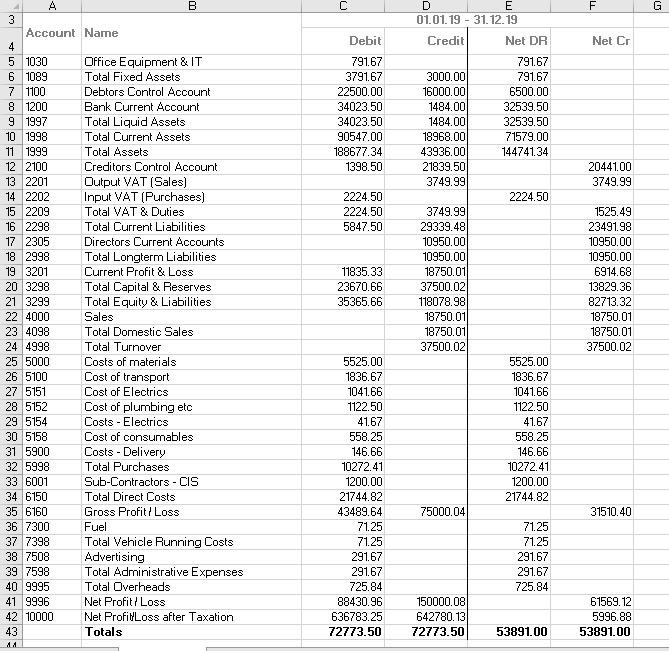

Accounting And Year End Closing Cashctrl

Parts of this service will be.

. It also benefits accounting practices with innovative excel working paper style. So completing your Year. Im setting up my new business and have had an enquiry to submit year end accounts quarterly VAT returns 2 x SA tax returns and bookkeeping.

Year End Accounts. 13 items to include on an accounting year end checklist. The company is tiny and.

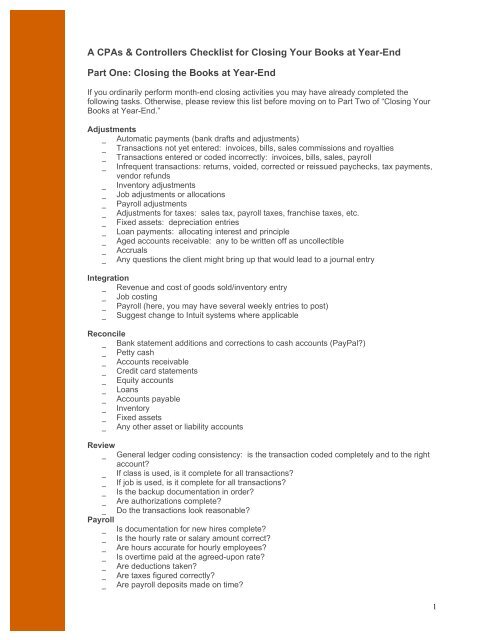

The way to accrue this expense is to record. Because we deal with the day-to-day bookkeeping and accounting we will have all the information we need at our fingertips. Investigate unusual transactions and post adjustments before year end.

Includes Partnership Tax Return. Turnover up to 100000. These include reporting and data processing deadlines and the fiscal close.

The cost of accountancy fees for Limited company accounts start at 250 for a low turnover company. One-Off Fee Guarantee Price Fixed For 3 Years. If the accounting staff is proactive and doesnt put off work until after 1231 the year.

Prepare a closing schedule. For a company turning over between 20000 to 50000 a one-off business accounting cost would be between 150 to 200 while for companies turning over between. In this case a separate retained earnings account was created for each combination of a department and a cost center.

By doing so it will have liquidated. Ive just had my accounts finished by my accountant for my year end. Preparation of Partnership Accounts.

An accrued expense of 3000 must be recorded as of June 30 to ensure that the expense is properly accounted for in the current fiscal year. For self assessment accountant fees we charge 149 for a basic return. Go to Accounting Year End Close.

The year-end for a business is typically selected to be at the end of a month in which the organization has experienced declining activity. Complete tasks before year end. Filing Company Year End Accounts with HMRC.

Accounts filed within 7-14 days. When the year-end close is run for fiscal year. Consider including these 13 items on your accounting year end checklist to prepare for the next fiscal year.

Identify the important dates and the activities that must be completed by each. Outsourcing of Year End Accounts will benefit accounting practices with cost savings of more than 50.

Small Business Accounting Services E Commerce Accountants London

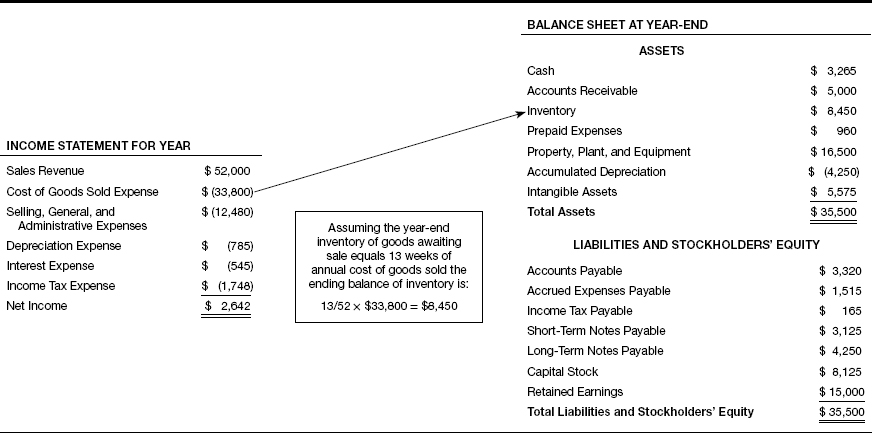

Cost Of Sales Formula Calculator Examples With Excel Template

How Much Should Accounting Cost A Small Business

What Is Cost Of Goods Sold Cogs And How To Calculate It

Abc Of Accounting The Year End Closing Entries

Simon Company S Year End Balance Sheets Follow At December 31 2015 Brainly Com

Chapter 6 Cost Of Goods Sold Expense And Inventory How To Read A Financial Report Wringing Vital Signs Out Of The Numbers 8th Edition Book

Year End Accounting For Limited Companies Made Simple

A Cpas Amp Controllers Checklist For Closing Your Books At Year End

Proper Planning Can Save You Time And Money On Your Year End Audit Kraftcpas

How To Prepare Annual Accounts For Company Investments Foxy Monkey

Solved Problem 12 5 Aicpa Adapted Tarmac Company Prepared A Trial Balance At Year End Which Included The Following Accounts Sales 100 000 Units Course Hero

The Amounts Of The Assets And Liabilities Of Journey Travel Agency At December 31 2018 The End Of Brainly Com

Components Of The Income Statement Accountingcoach

Accounting 101 How Much Does An Accountant Cost Ageras

Cost Of Goods Sold Learn How To Calculate Account For Cogs

10 End Of Year Bookkeeping Tips

Quiz Pdf Cost Of Goods Sold Inventory

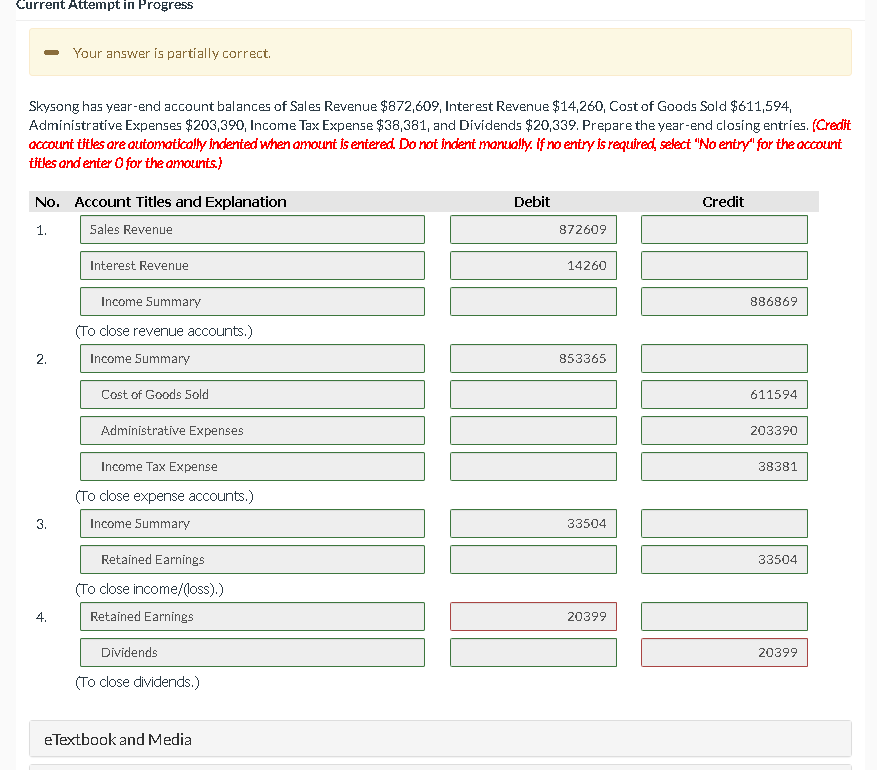

Solved Current Attempt In Progress Your Answer Is Partially Chegg Com